Our Financing Hvac Diaries

Table of ContentsEverything about Financing HvacSome Known Incorrect Statements About Financing Hvac Rumored Buzz on Financing HvacFinancing Hvac for BeginnersThe 25-Second Trick For Financing Hvac

If your credit isn't quite well, you might need to pay dramatically greater interest prices than those with far better credit rating, and you might have fewer loaning alternatives. If you have immediate but relatively minor repairs of much less than $1,000, you might have the ability to qualify for a house enhancement credit history card for those with poor credit report.You can use your card for other cooling or home improvement expenditures as they show up (as much as your credit line, naturally). Charge card generally have the highest rate of interest rate of your cooling funding choices (financing hvac). If your credit score isn't fantastic, you might have a rate of interest rate of 20% or even more.

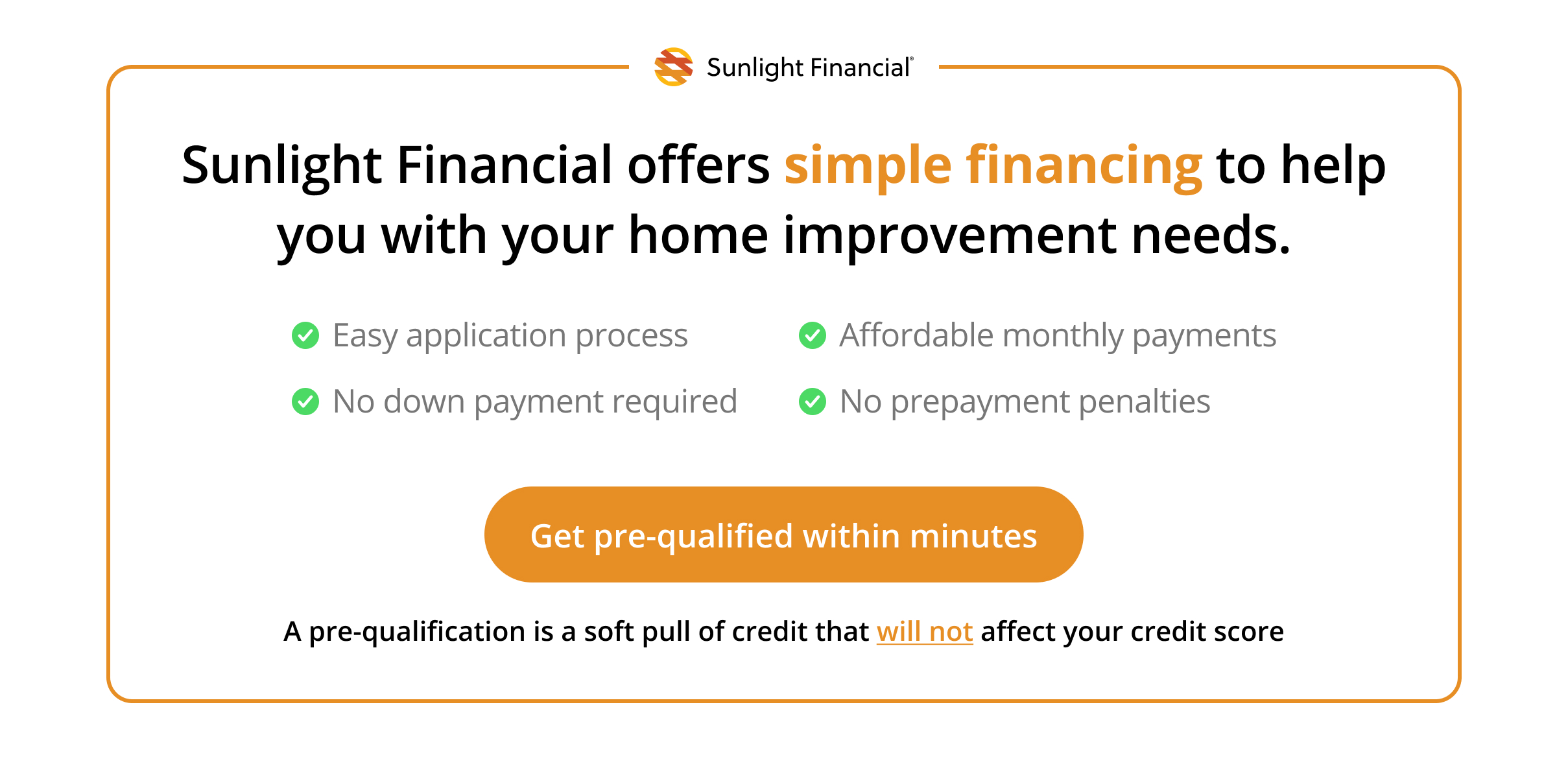

Ready to see your options? Click to request an individual home improvement funding or home improvement credit report card for bad credit rating. The first request generally takes much less than 3 minutes to complete, Evaluation your choices and also select the one that functions finest with your budget and a/c finance requirements.

What Does Financing Hvac Mean?

Even if you have poor credit history, Fireplace can aid you obtain the air conditioning funding you require to stay trendy as well as comfy.

You might depend on air conditioner device funding to cover the high expense of a cooling system or repairs. Choices include personal fundings, HELOCs, house equity fundings, bank card, and HVAC company funding.

Right here are some inquiries and solutions about the price of a new AC unit, ought to you come across that sudden expense, and also just how to fund it. The expense of a new air conditioning unit depends upon a few aspects: Kind of system Cost of installation Dimension of your home The air conditioner device itself will commonly set you back in between $1,000 and $5,000, according to home renovation source Home, Guide.

Those expenses can rise as high as $10,000 or even more if the setup is comprehensive or challenging. That's a substantial amount of cash for many individuals, and paying of pocket may not be an option for every person. If that holds true great site for you, financing via a loan or various other credit rating item may be the best alternative to keep you and also your household out of the heat with a brand-new ac unit.

Financing Hvac - An Overview

It is an extra accurate step of your expense for loaning. ** If you have a continuing to be equilibrium when the deal ends, you'll normally be billed interest from the purchase date.

One benefit of a house equity loan for this purpose is the ability to subtract the passion you pay on the loan from your taxable earnings. Simply realize that your borrowing is normally limited to 85% of the equity you've built up. On the other hand, a residence equity line of credit rating resembles a bank card it's a rotating line of credit that utilizes your residence's equity as collateral, and also you'll pay passion on whatever quantity you make use of.

To certify, you'll typically need a loan-to-value proportion of 85% or less. But, in addition to the rate of interest, you'll have to pay closing prices (commonly 2% to 5% of the total funding) so you'll have to take into consideration those prices when finding out the real price of pop over to these guys borrowing. Individual financings are one more AC financing choice you may intend to consider.

There are alternatives if you have bad debt, too though those are usually much more pricey. Commonly, lending institutions think about elements like your revenue, debt and current financial debt amounts to figure out if you certify and also, if so, what the terms would be for your car loan. Some stores and specialists supply funding options, like a installment plan card that comes with unique funding and also loans; these may likewise be used with a third-party lender.

Little Known Facts About Financing Hvac.

Commonly these are smaller car loans with much shorter terms than you would certainly locate with a traditional finance so if you require more than $1,000 to finance your brand-new cooling device, you might require to consider other choices. If you can not get approved for normal funding, you could be used lease-to-own as an air conditioner financing alternative.

Yet that will rely on aspects like the dimension of your house and also the type of device you buy. Tiny repair services, on the various other hand, can range from $150 to $650, while bigger repairs may set you back as much as $2,500 or even more. Some retailers as well as professionals supply financing choices, like shop cards and also finances.

Financing Hvac Things To Know Before You Get This

This can cause new jobs and also more rewarding agreements as customers start to speak up your solutions. financing hvac. Currently you know the why of going after organization funding however what's the most effective means to get the cash you require? Below are 5 common options for handling your cooling and heating business costs this summer season.